1 TD Bank Mobile Deposit is available to customers of at least 90 days or longer with an active checking, savings or money market account. Available for most iPhone and Android devices. Other restrictions may apply. Please refer to the Mobile Deposit Addendum (opens new window). Is there a limit to the amount I can deposit using TD Mobile Deposit? Yes, there are limits on the amount of funds you can deposit on a daily and rolling 30-day basis. Your Mobile Deposit cheque(s) Daily Limit and your 30-Day Limit will be displayed under the Amount field in the Deposit Cheque screen.

Bank on the go – it's fast, easy and secure.

Manage your finances anytime, anywhere with our mobile app, now with Mobile Deposit.

As an Online Banking customer, you can download the TD Mobile app and bank right on your smartphone. It's secure, convenient and no cost to you. Our app has the highest standards for security, plus it's fast and easy to use. View deposits, loans, credit card, debit purchases and account balances, plus pending transactions and account history – all in real time. Make transfers, deposits and bill payments, or find the nearest TD Bank or ATM, including directions. Plus there's more: report a lost or stolen card, get answers to FAQs or send the app to your friends.

Td Bank Mobile Deposit Funds Availability

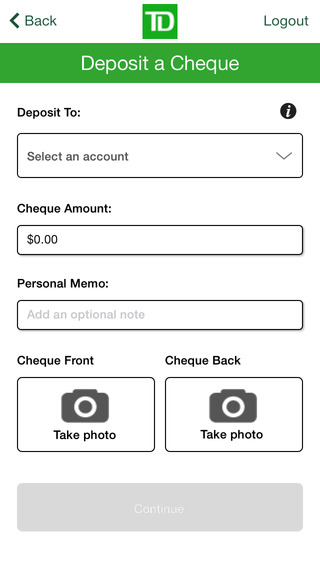

Now depositing checks is as simple as taking a picture. With TD Bank Mobile Deposit you can securely deposit checks right from your phone. Bank anytime, anywhere – 24 hours a day, 7 days a week. Save time, gas and paper, and access your funds the next business day.1

Download the app to your PC and sync to your phone2

At TD Bank, there's always someone to talk to about your account. Call us or come in today.

If you have the FM deposit hold-see SM in your account statement, here is the page for you.

Td Bank Mobile Deposit Money Order

This post promises to explain everything about deposit hold-see SM to you.

What it means, how long it takes and many other things that are relating to FM deposit hold-see SM that will get you well informed.

The bank might put a hold on the bank for an excessive amount of time.

But really, why is the bank putting the hold on the checks?

Make sure you read between the lines so you don’t miss anything.

Most of these strange bank statements are synonymous with the TD banks.

Even when I shared the V5 inc ret ps on TD bank statement.

It was also a case with the TD bank.

FM deposit hold-see SM

You are getting this in your account statement because you tried using the TD bank mobile deposit app to deposit some check(s) and it did not go through.

If you tried this during the weekends, you may have this hold you the transaction.

As long as your check doesn’t go through, you are likely to have the FM deposit hold-see SM reflecting in your account statement.

If any of your checks are marked as “FM deposit hold-see SM” then it means that there is a temporary hold on the checks.

Even if you visit a local TD Bank, you may be told that the deposit is scheduled to go through on a stipulated date and that there is nothing they can do about it.

What to when FM deposit hold-see SM reflects on your statement

There are a few things that you can do when you have this in your statement report.

You can talk to the management of the bank to see if you can be given some of the money upfront from the check that is waiting to go through.

If that request is granted, then you will have a negative sign in your account balance pending when the check will go through so the outstanding balance can be charged.

Though some people think there are instances where the bank will be holding the money and using it for business while reporting FM deposit hold-see SM in your statement to you.

What I would advise in this case

I would leave you with few tips to help curb the recurrence of FM deposit hold-see SM in your account statement.

You would agree with me that weekends are generally not good for business.

So to help mitigate some transaction delays, you might want to avoid weekends at all costs.

Weekdays/workings are cool for business.

Also, checks do not clear as fast as people think so you might want to exercise some patience as banks do not talk to each other directly.

Share other thoughts to mitigate FM deposit hold-see SM if you have any.